Seeking Degreed Professionals, Part-Time Accounting & Customer Service, Telecommute

We are in the business of helping our clients start and grow their ventures, develop net worth, and then retain or transfer their accumulated wealth. Over the last 20 years, we have enjoyed ongoing success serving (location removed by poster) clients who typically are in a broad range of industries and have annual sales between $300K and $5 MM. We are looking for degreed professionals to work on a part-time basis in accounting/customer service. The schedule is flexible. You will work from your home office and the client’s site. Knowledge of accounting principles, computerized accounting software & spreadsheets is essential. Familiarity with taxes a plus.

Sounds like a great job. I found this in an online search. There are quite a few of these telecommuting jobs around. There is a website called virtualvocations.com that posts not only the type of job above, but a plethora of remote and telecommuting jobs. Typically these jobs are on a contract basis, with no stated permanency, and no commitment from either party. Hmm, if I had a multi-million dollar client not too sure I would want to have a contract, non-committed, low-wage employee (one I see infrequently at that) going out to collect sensitive source data, carrying it around with them, and working on clients’ accounting.

Wait a minute. With “Cloud” computing, online banking, online digital storage, and remote access, isn’t the high-end client already using technology that wouldn’t require an employee to go on-site? The client is probably in the cloud; they just don’t believe their accountant is, and their accountant doesn’t see any reason to change the belief. A low-wage contract employee can do the data entry. The accountant can then fix any mistakes and charge a sky-high hourly rate at the end of the quarter or year and produce those oh so beautifully compliant financial reports. Truly, how many of the clients of the firm seeking DEGREED PROFESSIONALS are really in the upper ranges of the numbers stated in the first paragraph? Most likely the majority are in the lower range.

At least once a week I hear accountants say, “my clients will not get me the information I need to perform their accounting tasks in a timely fashion.” “The bank my client uses does not provide read-only access.“ “My clients won’t pay to upgrade their accounting software.” “My clients won’t [fill in the blank here].” Of course your clients wouldn’t do anything to support making those beautiful, compliant financial reports any faster. Those reports provide little value for them. They are last quarter’s or last year’s news. They are often not read. But that nice data-entry person you send over does make sure the checking account balances.

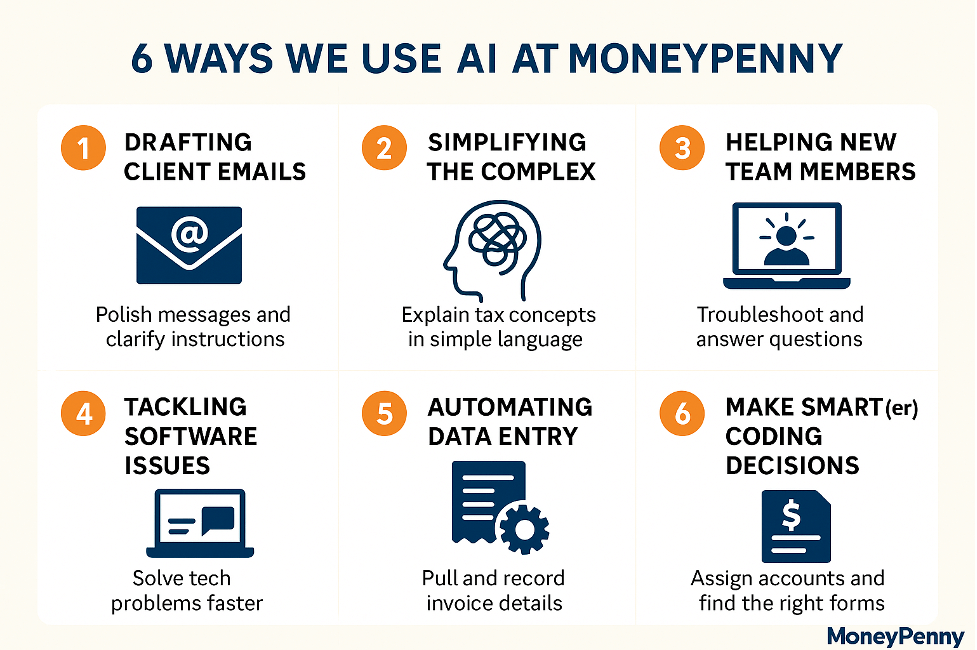

When an accountant starts with “My clients won’t…” I will call or visit the client in the guise of the ‘nice, data-entry person’ and show them one simple saving they can obtain by using some of the technology that’s available, such as SmartVault, bill.com, Shopify, or a hosted accounting software. I’ll have them call the bank and ask for a read-only access user. I’ll address all the other ‘won’ts.’ Funny thing is I never get a no.

So before you think or say “My clients won’t….,” go, meet them face-to-face in their location and ask. You also may get a smile and a yes. Becoming the CFO value-added CPA/Accountant is not just about re-tooling your technology or establishing a pricing structure and developing an SLA. Those are all important, yes, but before all that you must first put down that #2 pencil, step away from your desk, and stretch your hand out to your client.